Conviction. Dicitonary.com defines it as “a fixed or firm belief”, Merriam Webster elaborates as “the state of being convinced.” However, you view it, right now is where it is most important. I’ll elaborate.

China Cracks Down

We saw another slide in bitcoin this week as China encouraged banks and payment platforms to stop supporting digital currency. This, of course, led to a further decline in bitcoin’s price and it broke $30,000 and, I’m not going to sugar coat it – this sent huge ripples through the market, at least, for the short term. Let’s unpack this for a second though.

Bitcoin is self-sovereign, like gold. It’s not backed by any government or institution. These are deliberate and intentional properties of the asset. China (like most governments) likes control, and in the case of China more so than most. This is not news. So, it’s not surprising then, that as the world of crypto assets gain’s momentum, that they crack down harder. That’s how things work. It’s how people operate. It’s how governments operate. I wouldn’t expect a change now around crypto.

This is where conviction comes in. I am a crypto bull, so let’s just put that on the table. Not just a bitcoin bull, mind you, but a crypto bull. I see it as one of the greatest technological revolutions of our time and the foundation of technological underpinnings of the next decade(s). We’ve already seen huge movement, the biggest banks in the world, the biggest businesses in the world and the biggest investors in the world weigh in their endorsements. I have worked hard in my blogs to explain the foundations of this conviction as this technology will transform banking, law, business, finance – the list goes on and on. This conviction is shared by well-regarded investor Mike Novogratz who weighed in with his thoughts noting “Of course I’m less happy than when it was $60,000, but I’m not nervous”.

History has given us a template, and to that end lets look at just one use case. Amazon, the industry juggernaut, spent years without generating profit, fueling naysayers. Naysayers bashed for, in some cases, decades as price and performance were challenged, doubted and by some, ridiculed. Well, we all know the end of that story. Bezos had conviction.

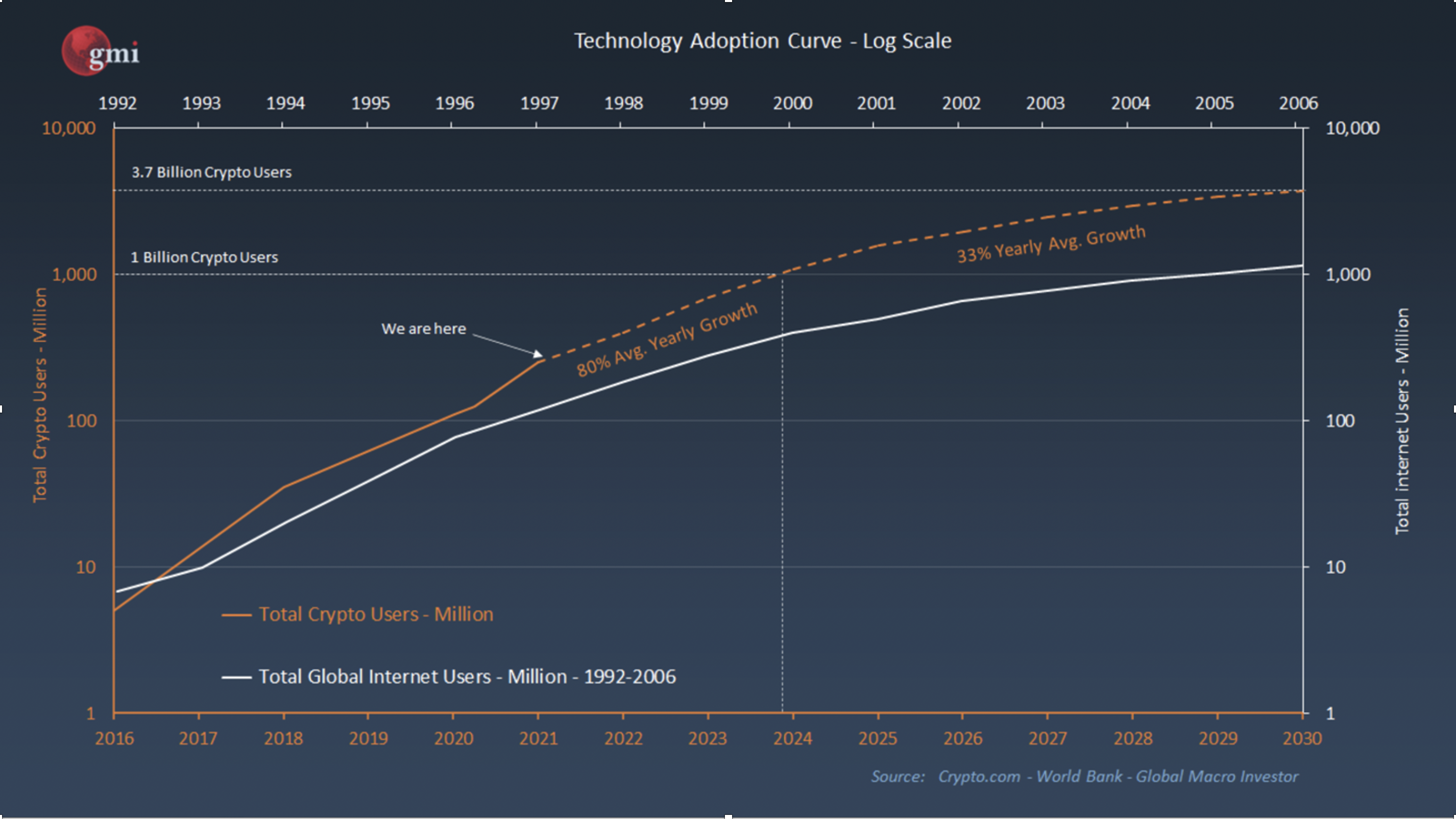

Also worth noting is that most people look at bitcoin as related to financial markets, but let’s remember that bitcoin and crypto assets are technologies. Noted investor Raoul Pal cites this excellent chart from Global Macro Investor, observing that crypto investors are investing in the fastest rate of adoption of any technology in all of history. That includes the internet. With that kind of adoption, yes, you have volatility. It’s kind of par for the course.

So, forget the hype. Crypto is not a “get rich quick” scheme. It’s a technological revolution. Revolutions have ups and downs, battles won and lost. If you bought bitcoin at $60K because you were afraid you were going to miss it, of course you don’t like it at $30K. However, once it hits $100K, you’ll be vindicated. Anyone who’s held bitcoin for 3.25 years or more has made money.

Speaking of noise, I’d be remiss not to mention the voices that seem to occur at each level. “I can’t buy at $60K, it’s too high!”; “I can’t buy at $30K, it’s too low.” Hmmm. Maybe finding reasons to NOT jump in are just part of the human condition. I do want to note that every time the markets drop it seems institutions and the big boys just buy more.

As another example, Alaska Airline’s stock was at $66 before the pandemic hit. It then got cut down to $23, a 66% drop! Those that had conviction (we would survive the pandemic) and a longer lens took that as a buying opportunity and, guess what, Alaska’s stock was $63 as of Tuesday June 22. Everyone knows that the pandemic was brutal on many fronts but while the doomsayers gave up on the world those with conviction saw opportunity.

I’m not saying it’s easy. I’m not saying it’s comfortable. I’m just saying that it’s simply what it takes. Any great success has had to go through periods of difficultly. I’m sure you can find two or three in your own life where you’ve persevered and come through the other side. Sports is a great analogy, by the way. Every championship team has gone through heartache and moments where victory seemed impossible. Some fans remember those moments. Some don’t. But I promise you, while everyone is relishing victory at the end, the team certainly remembers the road to get there, and it’s rarely in a straight line.

Buy Low, Sell High (sort of)

We all know the adage buy low and sell high. Yet, there is also something to be said about being in markets and not trying to time them to oblivion (a fools errand). I’m going to tap the way back machine here and note an article from Fundstrat’s Tom Lee reminding us that the majority of gains in bitcoin bull runs have come during the ten best days of the year, (and oftentimes those are right after the worst days of the year.)

Meanwhile

Meanwhile, let’s look at a few seminal events that may have been overlooked over the past few weeks.

El Salvador made bitcoin legal tender. I cannot overstate the importance of this. We now have a country – what we expect to be the first of many – that is recognizing this asset as a legal form of exchange. It’s a watershed moment, and it won’t be the last.

The FBI recovered Colonial Pipeline’s ransom Money. In a blow to the “only criminals use crypto because it’s untraceable” narrative, the FBI recovered $2.3 M of the $4.4M paid in ransom by tracking it. It’s true that crypto is about empowering individuals so they have freedom and flexibility without a central control. This does not mean that it’s immune to observation, laws and, frankly, common sense.

Blackrock goes bitcoin. The world largest asset manager is now looking to integrate bitcoin into Aladdin (Asset, Liability, Debt and Derivative Investment Network) which is known as BlackRock’s crown jewel. The adoption by this major money manager with over $7.8 trillion in assets under management is huge vote of confidence in the long-term durability of the world of crypto assets.

In Closing

Remember that control is central to governments and crypto wrests some of that control from them, which will certainly create waves. This is but one data point, however. We still have a long-term bullish outcome and see huge gains on the horizon. It may take a little more time to get there, but that’s how it goes sometimes (and is why we focus on year-by-year performance because, yes, these markets are volatile.) I encourage investors, the crypto curious and anyone reading this to do a deep dive, continue learning and determine for themselves what they see over the long haul. This is the root of conviction, and conviction will carry the day.

Until next time be well, stay safe, and we’ll continue to Decrypt: Crypto for you!