I’ll start with the Mr. Obvious award. We’re in a bear. It’s a big growling grizzly and it’s got center stage. All markets have taken a beating and crypto has taken a serious beating. With bitcoin down approximately -55% year to date and the widespread crypto markets down approximately -69% year to date. There is a ridiculous amount of fear in the markets.

There are a lot of reasons for fear. We’re coming out of a pandemic. Interest rates are rising, notably, with the Fed hiking rates by 0.75 percentage-points in June and a predicted additional 0.75 percentage points coming again in July. Inflation is at a 40-year high. Many believe a recession is imminent. The fact is – the economy is looking grim right now. It’s a scary time if you are long on crypto.

Perhaps, that is, unless you’ve lived through this before.

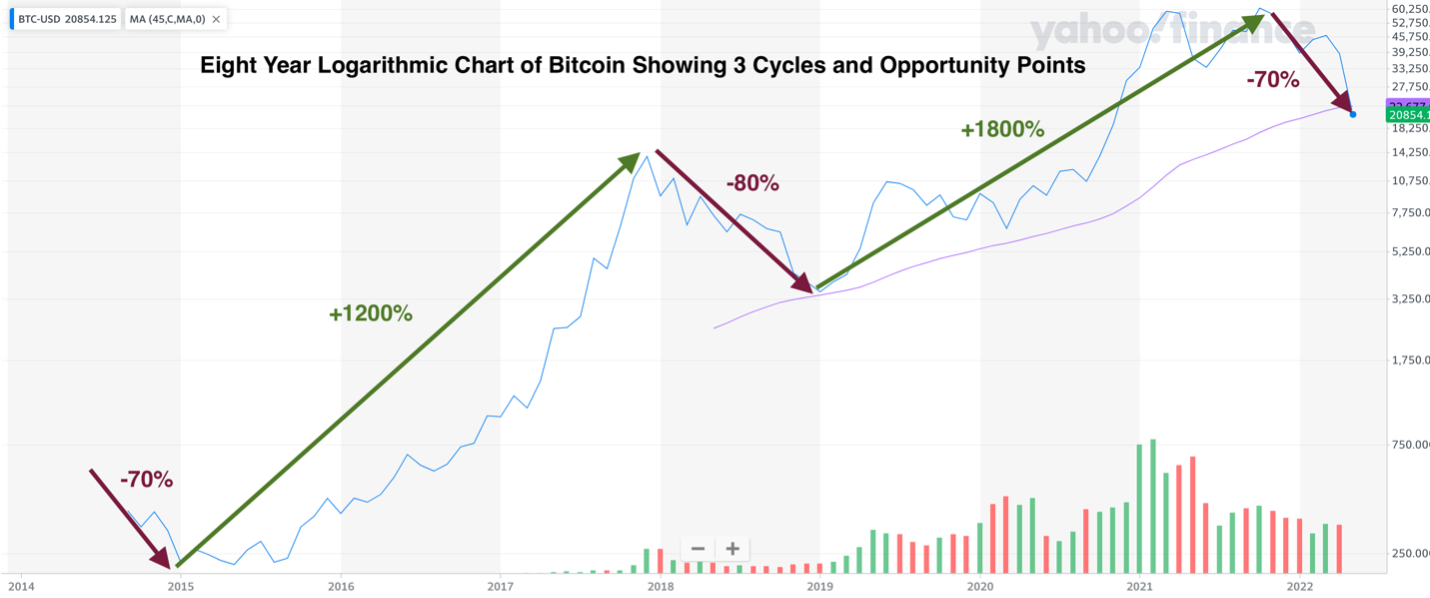

In 2014 and in 2018, we saw similar pullbacks, with BTC being 70% and 80% off its all-time high before rocketing to 1,400% and 1,800% gains, respectively. We’ve seen this pattern. It may well be that we’re at the exact same kind of bottom right now. Yes, market conditions are unusual. That doesn’t change the fact that for those that want massive gains – well – bottoms are the best time to deploy.

My goal in this particular blog is to provide some perspective, particularly as it relates to the crypto markets, and to shed some light on why the top investors in the world remain bullish on crypto even now. Quoting Paul Tudor Jones, “It’s hard not to want to be long crypto.”

Do You Believe in Technology?

Let’s get this right on the table. I’m biased. I’m a crypto bull. Period. People ask me, “Even in markets like today?” Yes. Especially in markets like today. We’re experiencing what my CIO calls “Generational Buys” on select assets. Opportunities that may never happen again.

Yet, it’s somewhat counterintuitive, because when crypto is hot and markets are roaring, the fanfare is bold and pronounced. When crypto is cold and in a deep downturn, the naysayers love to say “Nay!” There’s an old adage, “Buy low, sell high.” Well folks, it’s really, really low right now. It’s difficult to compete with human psychology, however, and when things are down, we have a state of fear. What if it goes lower? It could certainly go lower, just as we had a falling knife in March 2020, but trying to catch the bottom of a bottom can be as challenging as trying to catch the top of a top. Timing the market is a fool’s errand, so it’s worth looking to see if value is present. I would argue that with crypto markets at approximately 85% of all-time highs, I assert, “Yes.” Yes, value is present. Here the famous Warren Buffet quote comes to mind – “When people are fearful, be greedy. When people are greedy, be fearful.” According to Mr. Buffet, this would certainly be a good time for greed.

Ultimately, I argue the question is not “Will crypto go up?” The question is “Do I believe in Blockchain? Do I believe in the Technology?” If the answer is yes, then the first question is best restated as “When will crypto go up?”

Let’s talk about technology for a second. The internet was invented in 1969 – it was called Arpanet and originally consisted of just four nodes. For decades it was largely a product of academia, with some repurposing by large online companies for the first retail use cases. (CompuServe, anyone?) It wasn’t until 1994, when Netscape was founded by Marc Andreessen and James Clark, that the internet really began to take off. Netscape Navigator gave everyone the ability to “go online” and opened the door to the internet as a technology that everyone could directly access and benefit from. On that timeline, it took 25 years from inception for the internet to gain any kind of real accessibility, and another 5 before it became really usable, then another 12 or so before we started to see the first instance of smartphones, which have made us all quasi cyborgs. In the Netscape era, we were just figuring this internet thing out. Businesses were formed. Some survived (Amazon), some collapsed spectacularly (Altavista, Pets.com), but at the end of the day it was the technology that carried the day.

Interestingly enough, at the same time in 1995, just as the internet was gaining traction with a paltry 16 million users, opinions were everywhere, one famously stating that the internet was a fad and that it would not make it past 1996. (I’ll just let that sit and pause for a moment for dramatic impact… Ok, good.)

We’re way past the fad point with blockchain and crypto. Companies will come and companies will go. Luna took a spectacular belly flop and Celsius is perhaps on deck to do the same. That’s what happens in growing markets. Not every business is going to succeed. Not every business should. Certainly, not every business is going to be Amazon and, let’s be honest, it took Amazon nine years to make any kind of profit at all, with plenty of naysayers along the way.

Any new technology adoption is rife with challenges. So, when we talk about crypto, I want to make one thing very clear. We’re talking about technology. From and investor standpoint, it is a technology investment.

Blockchain, having solved one of the top 10 computer science problems of all time, The Byzantine General’s Problem, allows us the ability to transact in a peer-to-peer way without central authority. The impact of this cannot be measured at this point in time, just as it would have been impossible to imagine the impact of smartphones and how they shape our lives now way back in 1994.

As one more data point, college campuses such as the one at University of Texas, Austin, are now combining their computer science and blockchain programs. This sends a clear message not only to the relevance and projected future of blockchain, but importantly it points to where the talent is going to be focused in the coming years. Blockchain is not going away.

Of Course It’s a Cycle!

Which brings us to the fear part of our program. OMG! Bitcoin is down 70% from all-time highs! Yes. Just like it was in 2014 before it soared 1400%. Just like it was in 2018 before it rocketed 1800%. So, now that it’s down 70%, I humbly submit that this is the time where deployed capital has an opportunity to enjoy significant upside gain. How much? Well, many experts still predict $100,000 bitcoin (or more). According to them it’s not an if, it’s a when. We further argue that select crypto assets representing solid technology projects will outpace that. Importantly, cycles have been pretty consistent, and we see nothing that points to the fact that this cycle would change. In fact, we see the support for it, as in today’s climate we have big banks, government, credit cards and businesses of all types all jumping into the crypto fray. Yes, the macro environment has to get cleaned up – and it will. Yes, we’re going to have businesses rise and fall. But this is why investments in this industry are measured in years, not months.

At the end of the day, for those of us that have been around for at least four years, it’s not our first rodeo. If this is your first cycle however, yes, this is a scary time. Hopefully I’ve provided some perspective to mitigate that fear.

Remember that this is a longer-term play. I suggest that you don’t play this game if you need a return in 2 months. Don’t get in if you want a return in 9 months. However, if you believe in the technology, and understand these cycles, I will argue this is the very best time to get in – and if you are in – this may be a time to double down.

From Our CIO’s Desk – Fed May Surprise Us

As an adjunct, our CIO, Jake Ryan, author of Crypto Asset Investing in the Age of Autonomy, wanted to be sure I highlighted his base case and why he sees now as a singular opportunity to deploy capital.

Jake’s medium-to-high conviction base case is that the majority of the capital destruction will happen this summer and inflation will peak this summer before receding below 8.6%. Along with that and perhaps more importantly, the Fed will ultimately be forced to change its stance to a more dovish stance sometime in the back half of the year. That’s when capital markets rise and, historically, crypto has risen farther, steeper and faster than other markets. Surprisingly, this could happen as early as late Q3, which is sooner than many predict. The discussion of this is worthy of its own blog but his case is based on a number of factors, including the need for some market relief for a functioning economy and, importantly, the impending mid-term elections in November. (Though this is a political driver, it’s a driver nonetheless.) This is a controversial view but is well substantiated, so if you want more specifics then I invite you to give Jake a call directly at our number below – market dynamics are one of his passions!

Ultimately, time will tell, but if this plays out anything like his base case then, truly, the best value in the markets is right now.

Celsius Melts Down

Switching gears, one of the reasons that crypto took a huge hit this month is Celsius. Celsius, is a centralized company that allows individuals to earn interest on deposited collateral and also take collateralized loans against their crypto. They were a market giant. There is an excellent overview on Yahoo!Finance which unpacks the debacle, but as an quick synopsis, Celsius Network LLC had over $8 billion lent out to clients and $12 billion in assets under management (AUM) as of May 2022. However, in a surprising announcement, the firm announced on June 12th that it would stop withdrawals from its platform, citing ‘extreme market conditions.’

That’s bad news. When people cannot get their money, it’s very bad news. (Note that our CIO saw the writing on the wall and as such our Fund had no exposure to Celsius when it halted funds. Unfortunately, not everyone had this foresight.) The company, it seems, was overleveraged, and didn’t have the capital to honor its obligations. They are still figuring out how to recover and, ultimately, we’ll have to see how this plays out. The company has not filed Chapter 11, though encouraged to do so by advisers, and according to their press releases Celsius is committed to honoring their obligations. Will another company buy them? Maybe. They present a tasty opportunity with a wide client base for others in that industry to gobble up. It’s also certainly possible that they will file for bankruptcy (and then get likely get gobbled up).

Please understand I’m not making light of this. I am sensitive to the plight of those who are wanting Celsius to release its freeze on withdrawals. Personally, I have dear friends who have money locked. This is real and impactful on the Celsius users. I would like to see it resolved with no loss of client funds.

From a broader point of view, this is a cautionary tale, as not every business operating in a new technological field succeeds. Businesses come and businesses go. Some succeed and some fail. It’s the way of it. It is unfortunate that this has come on the heels of the Luna meltdown, but this is also a part of the consolidation period that marketplaces experience when in high growth markets. We’ve seen it in the commercialization of the internet and we’re going to see it here. Celsius won’t be the last company to blow up. It’s just a part of the process. It does not inherently mean that blockchain and crypto lending institutions are bad any more than AltaVista’s failure meant that search engines are bad. It just wasn’t the right implementation.

In Closing

Bear markets in general are no fun, and this one has extra pointy teeth because of the economic climate. That, however, is when the Buffets of the world historically make their moves, because that is where the greatest gains are garnered. There are a lot of people that made a lot of money by deploying capital in the recession of 2008. Here we are again, but now we have a new asset class, crypto.

Inside of this class, I would agree that there are a lot of nonsense crypto assets out there. There are also exceptional implementations that are, right now, preparing the technological foundation for decades to come. Those, from our purview, are the sound investments over time. At prices like we see today, this may be the very best time to take the long view, shun fear, embrace greed, and deploy that capital.

As always, much more to say. As always, I seem to have gone long so we’ll pause here.

Until next time, be well, stay safe, and I’ll keep Decrypting:Crypto for you!